Account Management

MyCFS

Creating a MyCFS account

How can I find my MyCFS login email/password?

Invalid login attempt

Reset your MyCFS password (when you don't know what it is)

Reset your MyCFS password (when you know your password but want to change it)

Why do I need a MyCFS account?

Purchasing

Adding an item to your shopping cart

Can I be invoiced or billed for my order? Can I pay by check?

Can I have my programs delivered on CD?

Can I order prior year tax forms?

Do I need to renew every year?

How are shipping costs for forms, folders and envelopes calculated?

How can I update my credit card information with CFS?

How do I manage my payment, billing, or credit card info?

How do I pay by check?

How do I view my order history?

How long does it take to get custom folders?

Ordering Custom Folders

Purchasing Tax Forms, Folders, Envelopes and Checks

Purchasing tax forms and related envelopes

Removing an item from your shopping cart

Requesting sample tax supplies

Should I buy Payroll Suite?

Starter Kits Discontinued

Tax Supplies minimum quantity is 150 units (checks is 500)

What are Auto-renewals?

What shipping options are available to Alaska and Hawaii customers?

When am I supposed to renew?

When will I receive my order?

When will my order be shipped?

Where's my receipt?

Why can't I order forms and envelopes over the phone?

Why can't I send CFS a fax?

Why didn’t you tell me to renew my programs?

Why does CFS no longer send renewal packets?

Can I get a user’s manual for CFS programs?

Does CFS need to know my EIN?

How can I find the status of my order?

How do I contact CFS for technical support?

How to edit my firm information in my CFS program(s)

Quick Reference Guide is discontinued

Where can I get help for Fill-N-Print?

FAQ

Are CFS 1099 forms compatible with QuickBooks?

Are CFS W-2 forms compatible with QuickBooks?

CFS Licensing/End User License Agreement (EULA)

Can 1094 or 1095 ACA forms be e-filed?

Can CFS software be used with cloud storage services (OneDrive, DropBox, Google Drive, etc.)?

Can I demo the W2/1099 e-file add-on?

Can I download my program to another computer?

Can I efile 941s, W2s or 1099s?

Can I use your program on both my office and home computers? (Single User versus Network)

Can Payroll System split an individual employee's Direct Deposit transaction between more than one account?

Can employees see their pay stubs online?

Can prior year's continuous use forms be used even though the year field is different?

Caution: for 2023, most users are required to E-File

Do I need to first input a client before I can use the program?

Does CFS carry the form to set up Section 125 health plan for an employer?

Does CFS have a Written Information Security Plan?

Does CFS have a penalty and interest calculator?

Does CFS have a program that tracks cryptocurrency?

Does CFS software support Beneficial Ownership Information Reporting?

Does CFS support Certified Payroll?

Does UPS require a signature upon delivery?

How can I find out what software is up for renewal and if I renewed?

How to switch browsers without changing the default

How will Payroll System handle OBBBA tips and overtime deductions?

Important Deadlines

Is CFS software compatible with Windows 11?

States supported by CFS Live Payroll and 941/940 Payroll System software

What are the advantages of downloading software instead of ordering CDs?

What do CD version numbers mean and how long should I keep them?

What is CFS' return policy?

What is the difference between the non-network and the network version?

What programs are compatible with Rightworks

What should I do when the items I ordered were damaged before I received them?

When are W-2s and 1099's (and 1098's) due?

When will the software be updated for a particular form?

Will LivePayroll custom payroll summary reports import from the prior year's program?

Internal

Program Instructions

General

Client Management

Clients

Adding or editing a client

Client Folder

Displaying additional client information in the Client List

Filter/Sort Client List

Finding Clients

Purge Deleted Clients

Set Client Codes

Data Migration

Backing up data to the cloud

Backup Considerations

CSV Import Guidelines

Data Locations (Default)

Export Client List

How do I back up/restore my data?

How do I backup to and restore from a CD or DVD?

How do I configure automatic backup?

How do I find missing backup data?

How do I move CFS programs and data to a new computer?

How do I move CFS programs and data to a new server?

How do I send client data to a colleague via email?

Importing client data between certain CFS programs

Importing clients from CSV file into TaxTools

Importing from non-consecutive program years

Lacerte Client List

Manually Importing Client Data From The Previous Year

ProSystem Client List

Restore

Why does Financial Planning Tools indicate restore database is being shared?

Why is the program not automatically backing up?

Printing a list of clients

Configuration

Change printers from inside the program

Change printers in Windows 10

Change printers in Windows 7

Configuration Options

Hide/Display State Forms

Installation

Can I install CFS programs on a Mac?

Downloading the installer to a USB flash drive to transfer it to an offline computer

Entering Data at a Client's Office

Finding a downloaded file

How do I download and install an update from within the program?

How do I download and install the single user version of a program?

How do I install a program or update in "safe mode?"

How do I manually download and install an update?

How do I map a network drive?

How do I perform a network installation?

How do I perform a workstation setup?

How to download and install software from the CFS website

Install Procedure - Add private database

Install Procedure - Continue private database next year

Installing in demo mode

Installing to a terminal server

Manual installation of a specific program from a CD

Reinstalling and repairing software

Software locations

Uninstalling

Where to download CFS software

Why does my desktop shortcut open the installer?

Why does the setup tell me to reboot the computer?

Workstation setup locations

Licensing

Can I use my CFS program on both my office and home computers?

Do I need a network license?

How do I change my address or firm name?

How do I edit my license code/firm information?

How does my license code work?

How many computers am I licensed for?

Using a License Code to access a program

What is the purpose of a network license?

Where can I find my Customer ID number?

Where can I find my license code?

Where to Find the License Agreement Screen

Why can't I call to update my firm name/address?

Why does my license code change?

Why does the installer tell me my license code is invalid?

Main Screen

About Screen

Add, edit, or delete a network user

CFS Program Interface

Calendar and Notes

Getting Started

Label Setup Options

Label/Envelope Maker

Network Utilities

Preparer/Representative Database

Selecting multiple records

Utilities

Modules

Data File List

Federal/State Tax Planner

Field Details for Numeric Fields

Form 2848 - Power of Attorney

Formatting a field for SSN or EIN (How do I change from a Social Security Number to an EIN?)

How do I print to a PDF?

Module Interface

Module Library

Two ways to print from a module

Using the Editor

Release Notes

CA Sales Tax Preparer

Financial Planning Tools 2025 Update History

MD Personal Property

NY Sales Tax Preparer

Payroll System 2024 Update History

Payroll System 2025 Update History

Payroll System 2025 Update History

Small Business Tools

Small Business Tools 2025 Update History

TaxTools 2025 Update History

TaxTools WorkShop Update History

W4 Calculator Update History

Security

One Big Beautiful Bill Act

Payroll System

E-Filing

1099 E-Filing

States

1099 E-Filing Module Overview

1099 E-Filing Step 1: Inputting Transmitter Data

1099 E-Filing Step 2: Create IRS file (FIRE or IRIS)

1099 E-Filing Step 3: IRS Submittal

1099 E-Filing Step 4: Create state file

1099 E-Filing Step 5: State Submittal

1099 E-Filing: Checking file status

1099 E-Filing: IRIS CSV Portal Combined Fed/State filing

1099 E-Filing: Navigating IRIS CSV Portal Website

1099 E-Filing: Navigating the IRS FIRE System Website

1099 E-Filing: Submitting IRIS CSV Portal corrections

1099 E-Filing: Submitting corrections via FIRE

1099 E-Filing: submitting prior year files

Adding Responsible Officials to a TCC application

Applying for FIRE Transmitter Control Code (TCC)

Applying for IRIS Transmitter Control Code (TCC)

Are you sure you filed ALL your 1099's on IRS's tricky IRIS site?

Can the same TCC be used for both FIRE and IRIS?

Checking Size of Uploaded File

Correcting and re-uploading erroneous IRIS files

Creating an IRS FIRE account

Differences between E-Filing with FIRE and IRIS

Does CFS support the Combined Federal/State Filing program?

FIRE System Upload: Navigating to your File

Finding the exact Company Name for logging into IRS FIRE

Finding your FIRE TCC

Getting Started: W-2 and 1099 E-Filing

IRS lowers E-Filing threshold to 10 information returns of any type

If you find an error on the Review Form Information page on IRIS

Logging into FIRE with Internet Explorer 6

Logging into IRS FIRE with a Company Name that matches IRS records

Printing Summaries and Reports

Uploading 1099 files to CA SWIFT website

What to do when you receive your FIRE TCC

Modules

CA Form FTB 6274 - Waiver Request From Filing Information Returns Electronically

CA Form FTB 6274A - Extension Request to File Information Returns Electronically

Form 4419 - Application for Filing Information Returns Electronically

Form 8508 - Application for a Waiver from Electronic Filing of Information Returns

Payroll Return E-filing

Forms 941, etc.

941 E-Filing Module Overview

94x (941/940/943/944/945) E-Filing Step 1: Create Submission Files

94x (941/940/943/944/945) E-Filing Step 2: Create Transmission Files

94x (941/940/943/944/945) E-Filing Step 3: Upload File

94x (941/940/943/944/945) E-Filing Step 4: Check Ack File

94x E-Filing Common Problems 94x (941/940/943/944/945)

ETIN: Modifying Your IRS E-Services Application to E-file Forms 94x (Forms 941, 940, etc.)

Fixing rejected 941 files

IRS migrates e-Services login to ID.me

Opening the E-File Federal Employment Tax Returns module

Requirements to E-File Forms 94x (941/940/943/944/945)

Retrieving Your External IPv4 Address

Signature Methods

Submit a Communications Test File

When will Form 941 be released?

CA Bulk Payment Record

CA Form DE 9C - e-Services Import a CSV File

CA Forms DE 9 and DE 9C

IRS requires new data to be included in business payroll tax return e-files

NYS-45/NYS-1 - E-filing (Web Upload Files)

New York E-Filing Overview

Online State UI Filing Support

Online UI Filing Support from the State UI Form Module

PA UC-2/2A - UCMS FTP or File Upload Support

W-2 E-Filing

States

BSO How do I know if I need to (re-) request, “SSA’s Services Suite for Employers”?

BSO changes login procedure and users must re-authenticate

Creating a Business Services Online (BSO) Account

Fixing a mistake made after e-filing W-2s

Requesting access to the SSA Services Suite for Employers on BSO website

W-2 E-Filing Error: "Specific information that is required to file an information return is missing. All errors must be corrected before the file can be created" and "Incorrect or Missing Employer Signer Name"

W-2 E-Filing Step 1: Inputting Submitter Data

W-2 E-Filing Step 2: Creating an SSA File

W-2 E-Filing Step 3: SSA Submittal

W-2 E-Filing Step 4: Create State File

W-2 E-Filing Step 5: State Submittal

W-2 E-Filing: BSO New Requirement

W-2 E-Filing: Checking the Submission Status

W-2 E-Filing: Navigating the SSA's Business Services Online Website

W2 E-Filing Module Overview

"SSN cannot begin with a 6 or a 9" when e-filing

Accepted with Errors – How to Find (and fix) Information Form Errors (IRIS, 1099)

BSO and IRS FIRE System is down for maintenance dates

Can 1099s be filed with IRIS (Information Returns Intake System)?

Create a Cover Letter to send to clients after E-Filing

Creating Form 8809 Extension files

Do I have to E-File?

Do I need formal approval from my clients to E-File for them?

E-File Format Error W2 and 1099 file name .txt

E-Filing: Copying and pasting file name and path

E-filing additional forms that weren't included in first submittal

Federal e-filing status page

Find a client's E-Filing status with the Database Summary report

Finding the TCC online - Do I have a TCC (FIRE or IRIS)?

Handling omitted payees when 1099's or W-2's are added after transmission

IRS requires existing TCC holders to complete the new IR application

Is the IRS website down?

Warning: Payroll System supports filing until the IRS and SSA BSO system year changeover in early December. After the system changeover, all files must be created with the current specifications used in Payroll System (for the current year)

What if I am too late to E-File?

FAQ

"The current license code does not allow access..."

Do I have to buy the Payroll Network license for every Payroll System program I have?

Do I have to buy the W2/1099 program even if I have LivePayroll?

Do I need to buy the W2/1099 program and W2/1099 E-File Add-on in order to electronically file W2/1099 returns?

Do W-2, W-3, 1099, or 1096 forms need to be printed on red forms or on plain paper in black ink?

Does CFS support WA Cares Fund for Long Term Care benefits?

Does Payroll System have password protection?

Finding a report of how many forms were prepared

Hourly rate is updated but Payroll System is still calculating at old rate

How Do I ... ?

How do I fix a duplicate reporting?

Printing SSA-approved, black scannable W-2 forms

Printing SSA-approved, black scannable W-3 forms

Prior Year Electronic Filing

The modules in W2/1099 are in red text instead of black text

What's New In Payroll System

When will Form 940 be released?

When will my program be released (or when will it be updated)?

Where is the 4th Quarter 941 module?

Where's my W2/1099 program?

Why can't I access the Payroll Corrector program?

Why can't I access the W2/1099 program?

Why don't you sell Payroll System as a package?

General (used in all 4 program parts)

Data Migration

Copy Employee/Recipient Info to Another Form

Copy Employee/Recipient to Another Client

Export Information Returns to CSV File

Export State Employee Wage Listing

Export client list to Excel

How to move CFS program Clients to a new computer (not a network)

Import last year's 1095-B/1095-C As Is

Importing CSV files into Payroll System

Importing payroll or 1099 data from Excel

Importing prior year clients/payees/preparers/labels

Merge different employees into an employer

Move employee/recipient to another client

Payroll System QuickBooks Import

Restoring a deleted employee

Transfer Payroll Data to W-2

Transfer Vendor Payment Data to CA Form 592-B

Transfer Vendor Payment Data to Form 1099

Transfer W-2 data to W-2c from current or prior years

Database Maintenance

Payroll System Database Reconstruction

Repair Client Database

Special Database Recovery Detail Instructions

Special Database Recovery Overview

Modules

Affordable Care Act: Notice to Employee of Coverage Options

CA Form DE 1 - Commercial Employer Account Registration and Update Form

CA Form DE 1 HW - Employers of Household Workers Registration and Update Form

CA Form DE 1245W - E-File and E-Pay Mandate Waiver Request

CA Form DE 2251A - Affidavit of Mailing

CA Form DE 34 - Report of New Employee(s)

CA Form DE 4 - Employee's Withholding Allowance Certificate

CA Form DE 48 - Power of Attorney

CA Form DE 542 - Report of Independent Contractor(s)

CA Form DE 89 - Employer of Household Worker Election Notice

Cover Letter

Fax Transmission Cover Sheet

Finding 2nd Quarter Form 941 (2022 revision)

Florida Form RTS-3, Employer Account Change Form

Form 1094-B / 1095-B

Form 1094-C / 1095-C

Form 2848 - Power of Attorney and Declaration of Representative

Form 8809, Application for Extension of Time To File Information Returns

Form 8821, Tax Information Authorization

Form 8822-B - Change of Address - Business

Form 8952 - Application for Voluntary Classification Settlement Program (VCSP)

Form I-9, Employment Eligibility Verification

Form SS-4 - Application for Employer Identification Number

Form W-4 - Employee's Withholding Allowance Certificate

Form W-9 - Request for Taxpayer Identification Number and Certification

Invoice Generator

Memo

NY Form DTF-95 - Business Tax Account Update

NY Form DTF-96 - Report of Address Change for Business Tax Accounts

NY Form POA-1 - Power of Attorney

NY Form TR-2000 - E-ZRep Tax Information Access and Transaction Authorization Form

Paycheck Withholding Calculator

Statement of Account

To Do List

Withholding Tax Rate Tables

Program Operation and Utilities

About Screen

Active/Inactive Employees/Recipients

Adding employers and payers to the Client List

Calculation Methods

Client List Options

Client Status Fields

Create a copy of a client

Deleting an employee or a form

Displaying client details in the Client List

Employee/Recipient Options

End User License Agreement (EULA) Screen

Find Client

Find Employees/Recipients

Firm/License Information Screen

Import Prior Year W-2/1099 for E-filing Purposes

Network Utilities (Network Version Only)

Payroll Client Folder

Payroll Client List

Payroll Configuration Options

Payroll Firm/License Information Screen

Payroll Label/Envelope Maker

Payroll Module Interface

Payroll Module Library

Payroll System Overview

Payroll: Getting Started

Printing a Custom Report displaying active employees

Report Viewer Screen

Restore Backed-Up Data

Restore Deleted Clients

Selecting employees

Components of Payroll System

Payroll (ATF and Live)

LivePayroll

After-the-Fact Payroll is included in LivePayroll

Blank Check Setup

Can users submit tax liability payments through the direct deposit feature in CFS LivePayroll software?

Check Printing Supplies

Correcting 941 for missing ERC (Employee Retention Credit)

Creating a local rate schedule file

Direct Deposit Error code: 3

Direct Deposit in LivePayroll

Gross-up for All Taxes and Deductions

Illustrated examples of Direct Deposit scenarios

Live Payroll Setup utility

LivePayroll Overview

LivePayroll vs. After-the-Fact Payroll

NatPay Info

Paying 1099 recipients by Direct Deposit

Print Payroll Checks or stubs

Reprint, Modify or Delete a Check that has already been printed

Setting up a progressive or rate schedule tax

Setting up employee withholding

Setting up employers and employees in LivePayroll (Saving a new employee)

Setting up hourly employees

Setting up local withholding tax

Setting up vacation & sick leave

Typical Examples of Vacation/Sick Leave Policy Settings for Hourly and Salaried Employees

Vacation and Sick Leave in LivePayroll

Vacation/Sick Leave Employee Setup

Vacation/Sick Leave Overview

Vacation/Sick Leave Policy Setup

Vendor Check Utilities

Workers' Compensation Information

Workers' Compensation Report Setup

Workers' Compensation Setup

Modules

941-X - Simplest Procedure to add ERC (Employee Retention Credit)

Arizona AZFSET Web File for Withholding Return Filing

Arizona Form A1-APR - Annual Payment Withholding Tax Return

Arizona Form A1-QRT/A1-WP - Quarterly Withholding Tax Return

Arizona Form UC-018/020 Quarterly Unemployment Tax and Wage Report

Arizona Forms A1-R - Annual Withholding Reconciliation Return

CA EDD e-Services File Attachment

CA Form 592 - Resident and Nonresident Withholding Statement

CA Form 592-B - Resident and Nonresident Withholding Tax Statement

CA Form DE 3B HW - Employer of Household Worker(s) Quarterly Report of Wages and Withholdings

CA Form DE 3HW - Employer of Household Worker(s) Annual Payroll Tax Return

CA Form DE 88 - Payment Coupon

CA Form DE 9 - Quarterly Contribution Return and Report of Wages

CA Form DE 9C - Quarterly Contribution Return and Report of Wages (Continuation)

CO Form DR 1094 - Colorado W-2 Wage Withholding Tax Return

CO Form DR 1107 - 1099 Income Withholding Tax Return

CO Form UITR-1 - Your Quarterly Report of Wages Paid and Premiums Owed

CT Form CT-941 - Employer Quarterly Reconciliation of Withholding

CT Form CT-W3 – Connecticut Annual Reconciliation of Withholding

CT Form UC-2/5A/5B - Employer Contribution Return and Quarterly Earnings Report

CT UC-2/5A/5B - Bulk File Upload Support

FL Form RT-6 - Electronic Filing Instructions

FL Form RT-6 - Florida Quarterly Reemployment Compensation and Wage Report

FL Form RT-6 Electronic Filing Error Codes

Form 8453-EMP - E-file Declaration for Employment Tax Returns

Form 8655 - Reporting Agent Authorization

Form 8655 Reporting Agent List

Form 8879-EMP - E-file Authorization for Employment Tax Returns

Form 940 - Employer's Annual Federal Unemployment (FUTA) Tax Return

Form 941 - Employer's Quarterly Federal Tax Return

Form 943 - Employer's Annual Tax Return for Agricultural Employees

Form 944 - Employer's Annual Federal Tax Return

Form 945 - Annual Return of Withheld Federal Income Tax

Generic State Quarterly Unemployment Compensation and Wage Report

Georgia Form DOL-4N – Employer's Quarterly Tax and Wage Report

Georgia Form G-7 – Employer’s Quarterly Return For Monthly Payers and Voucher GA-V

Georgia Form G-7 – Employer’s Quarterly Return For Quarterly Payers

IL Form UI-3/40 - Employer's Contribution and Wage Report

IL Forms IL-941/IL-501 - Employer's Quarterly Withholding Income Tax Return

Instructions for Completing Employer Payroll Form WR-30

MD Forms DLLR/DUI 15/16 - Maryland Unemployment Insurance Quarterly Contribution and Employment Reports

MD MW506/MW506M - Employer's Return of Income Tax Report

MD MW508 - Annual Employer Withholding Reconciliation Return

MI Form 5080 - Sales, Use and Withholding Taxes Monthly/Quarterly Return (and Form 5095)

MI Form 5081 - Sales, Use and Withholding Taxes Annual Return

MI UIA 1028 - Employer's Quarterly Wage/Tax Report

Missouri Form MO-941 – Employer's Return of Income Taxes Withheld

Missouri Form MODES-4 – Quarterly Contribution and Wage Report

NC Web File Upload for Form NC-3

NJ-927 and WR-30 E-Filing Acknowledgement File

Nevada Form RPT3795/NEW0098 – Employer's Quarterly Contribution and Wage Report

New Jersey Form NJ-927/NJ-927-W and Form WR-30 E-Filing

New Jersey Form NJ-927/NJ-927-W/WR-30, Employer's Quarterly Report

New York Form MTA-305, Employer's Quarterly Metropolitan Commuter Transportation Mobility Tax Return

New York Form NYS-1, Return of Tax Withheld

New York Form NYS-45, Quarterly Combined Withholding, Wage Reporting and Unemployment Insurance Return

North Carolina Form NCUI-101 and NCUI-101X, Employer's Quarterly Tax and Wage Report and Amended , Employer's Quarterly Tax and Wage Report

North Carolina Withholding Forms

Payroll Deposit Records

Pennsylvania Form UC-2 – Employer's Report for Unemployment Compensation

South Carolina Form WH-1601, Withholding Tax Coupon

South Carolina Form WH-1605, SC Withholding Quarterly Tax Return

South Carolina Form WH-1606, SC Withholding Fourth Quarter/Annual Reconciliation

TN Form LB-0456/0851, Quarterly Unemployment Premium and Wage Report

Texas Forms C-3/C-4, Employer's Quarterly Report

UT Form 33H - File Upload Instructions

UT Form TC-941-E - File Upload Instructions

Utah Form 33H/33HA, Utah Employer Quarterly Wage List and Contribution Report

Utah Form TC-941-E, Utah Withholding Return

Utah Form TC-941PC, Payment Coupon for Utah Withholding Tax

VA Web Upload for Return Filing

Virginia Forms VA-5, VA-6, VA-15, VA-16

Virginia Forms VEC-FC-20/21 – Employer's Quarterly Tax Report

Washington State Form F212-055-000 - Quarterly Report for Industrial Insurance

Washington State Forms 5208A and 5208B, Employer's Quarterly Tax and Wage Detail Reports

Wisconsin Form UCT-101 and UC-7823-E, Quarterly Contribution Report and Quarterly Wage Report

Program Operation and Utilities

Add FUTA Only Adjustment

Add State UI Adjustment

Add paycheck item for calculating NY SDI

Adding or editing vendors

Auto – Personal Use

Choose between entering Payroll Data by Date or by Payee

Cost of Employer Sponsored Health Coverage

Creating paychecks for a multi-state employee

Custom Payroll Journal

Customizing the Payroll Data Grid with the Options button

Deduction Items

Employee/Payee Reports

Entering a new client in Payroll

Entering hours by decimal or by number of minutes

Entering vendor payments

Garnishments

Gross-up for Employer Paid FICA

Gross-up for Employer Paid FICA and CA SDI

Health Insurance Compensation for 2% Owners of S-Corps

Health Savings Account (HSA)

Income Items

New Jersey Payroll Setup

Opening the Payroll Data Grid

Paycheck Utilities

Payroll Data Grid shortcuts

Payroll Diagnostics

Payroll Summary Reports

Reordering the columns on the Payroll Data Grid

S Corp Paid Medical Insurance

Setting up an employer with employees in multiple states

Setting up paycheck items

Show/Hide Payee Info in Payroll Data Grid

State Roth IRA

Tax Items

Qualified Overtime: Setting up income items

Transferring tips and overtime amounts to Box 14 Payroll System 2025

Treasury Tipped Occupation Codes (TTOC)

Payroll Corrector

Modules

CA Form DE 678 - Tax and Wage Adjustment

CA Form DE 9ADJ - Quarterly Contribution and Wage Adjustment Form

Form 941-X – Adjusted Employer's QUARTERLY Federal Tax Return or Claim for Refund

Form 943-X – Adjusted Employer's ANNUAL Federal Tax Return for Agricultural Employees or Claim for Refund

Form 944-X – Adjusted Employer's ANNUAL Federal Tax Return or Claim for Refund

Form 945-X – Adjusted Annual Return of Withheld Federal Income Tax or Claim for Refund

Form W-2c and W-3c

MI Form 5082, Sales, Use and Withholding Taxes Amended Annual Return

MI Form 5092, Sales, Use and Withholding Taxes Amended Monthly/Quarterly Return

New York Form NYS-45-X, Amended Quarterly Combined W/H, Wage Reporting and UI Return

W-2c Summary Reports

Can Form 941-X be E-Filed?

Do I need Payroll Corrector to correct e-filed returns?

Does Payroll Corrector correct prior year's forms?

W2/1099

Modules

AZ Form A1-T - Withholding Transmittal of Wage and Tax Statements

CFS Form Order Worksheet

CO Form DR 1093 - Annual Transmittal of State W-2 Forms

CO Form DR 1106 - Annual Transmittal of State 1099 Forms

CT Form CT-1096 – Connecticut Annual Summary and Transmittal of Information Returns

CT Form CT-W3 or CT-1096- CSV File Upload Instructions

DE WTH-REC - Annual Withholding Reconciliation Statement (for e-file only)

DE WTH-REC - CSV File Upload Instructions

Form 1096 - Annual Summary and Transmittal of US Information Returns

Form 1098 - Mortgage Interest Statement

Form 1098-T - Tuition Statement

Form 1099-A - Acquisition or Abandonment of Secured Property

Form 1099-B - Proceeds From Broker and Barter Exchange Transactions

Form 1099-C - Cancellation of Debt

Form 1099-DIV - Dividends and Distributions

Form 1099-INT - Interest Income

Form 1099-MISC - Miscellaneous Information

Form 1099-NEC - Nonemployee Compensation

Form 1099-PATR - Proceeds from Broker and Barter Exchange Transactions

Form 1099-R - Distributions From Pensions, etc.

Form 1099-S - Proceeds From Real Estate Transactions

Form 1099-SA - Distributions from an HSA, Archer MSA, or Medicare Advantage MSA

Form W-2 and W-3

Form W-2G - Certain Gambling Winnings

GA Form G-1003 - CSV File Upload Instructions

GA Form G-1003 – Income Statement Return

ID Form 967 -Idaho Annual Withholding Report

MO Form MO W-3 - Transmittal of Tax Statements

NJ Form NJ-W-3 - Reconciliation of Tax Withheld

North Carolina Form NC-3, Annual Withholding Reconciliation

OR Form OR-WR- Electronic Filing Instructions

Ohio IT 3, Transmittal of W-2 and 1099-R Statements

Oregon Form OR-WR – Annual Withholding Tax Reconciliation Report

PA Form REV-1667 - Annual Withholding Reconciliation Statement

PA Form REV-1667 - CSV File Upload Instructions

Qualified Overtime Calculator

Reporting Qualified Overtime 2025 W-2

South Carolina Form WH-1612 – Transmittal Form for W-2s or 1099s Submitted by Paper

West Virginia Form WV/IT-103 - Withholding Year End Reconciliation

What is the difference between 1099-MISC and 1099-NEC?

Program Operation and Utilities

Can forms be printed to separate PDF files for each recipient?

Create IRS Bulk TIN Matching File

Create SSN Verification Upload File

Formatting the Recipient field on Forms 1099: How do I change from separate first, MI and last name to a single entity name?

Mask an employee's SSN/TIN on printed payee statements

Printer Alignment

Printing Information Returns

Read IRS Bulk TIN Matching Results File

W-2/1099 Summary Reports

W2/1099: Transferring data between 1099-MISC form and 1099-NEC form

Golden parachute payments can no longer be filed through FIRE

Reconcile W-2s with 941

Which forms/envelopes are compatible with CFS W2/1099 Software?

How can I tell what states are supported by CFS Payroll System?

Specialized Programs

CA Sales Tax Preparer

Financial Planning Tools

Forms Library

NY Sales Tax Preparer

CT Form OS-114 - Sales and Use Tax Return

Form FT-945/1045 - Sales Tax Prepayment on Motor Fuel/Diesel Motor Fuel Return

Form ST-809 - New York State and Local Sales and Use Tax Return for Part-Quarterly (Monthly) Filers

NY Form FT-943 - Quarterly Inventory Report by Retail Service Stations and Fixed Base Operators

NY Form ST-100 - New York State and Local Quarterly Sales and Use Tax Return

NY Form ST-101 - New York State and Local Annual Sales and Use Tax Return

NY Form ST-810 - New York State and Local Quarterly Sales and Use Tax Return for Part-Quarterly (Monthly) Filers

Changes with Fill-N-Print

Fill-N-Print Discontinued

Quick Reference Guide

Tax Corresponder

W-4 Calculator

TaxTools

TaxTools WorkShop

Features

Browse or search through all Toolboxes

Client password protection

Customize how a Client's Files are listed

Downloading IRS PDF forms

Filtering clients based on the selected Toolbox

Free tools inside TaxTools WorkShop

Integrated knowledge base

PowerTools interface

Removing client password protection

Search for clients, client's files, and tools

Switching products using the Toolbox pulldown

Tagging clients

TaxTools WorkShop feature: Add your own PDFs to a Client's Files folder

TaxTools Workshop: Managing inactive clients

TaxTools Workshop: Setting automatic backups

Getting Started

All sales/property tax products can be found in the Sales and Property Tax toolbox

Carry files over to next year

Change screen font size

Check for TaxTools WorkShop updates

Connecting to an Existing Network Database

Copy Data Between Single User and Network

Creating a new network database

Deleting Clients

Firm Information Screen

How do I add email addresses or usernames for other users to grant them access to TaxTools WorkShop?

Importing clients from a CSV file

Importing clients from other CFS software into TaxTools WorkShop

Importing from Lacerte

Installation Instructions

Introduction to TaxTools WorkShop

Peforming a manual backup

Restoring from a .clad file

Rolling over client data

Running TaxTools WorkShop in the Windows Notification Area

Sorting and filtering by Client Code

Switching Between Single-User Mode and Network Mode

TaxTools Workshop: Importing from older programs

Using an email address to access a program

Licensing

Automatically extend subscriptions

Buying a subscription

Network upgrades and additional users

Partial-month subscription credit

Modules

Individual Tax Planner

CA Form 100, California Corporation Franchise or Income Tax Return

CA Form 100-ES, Corporation Estimated Tax

CA Form 100S, California S Corporation Franchise or Income Tax Return

CA Form 3519 - Payment for Automatic Extension for Individuals

CA Form 3520-BE, Business Entity or Group Nonresident Power of Attorney Declaration

CA Form 3520-PIT, Individual or Fiduciary Power of Attorney Declaration

CA Form 3520-RVK, Power of Attorney Declaration Revocation

CA Form 3522 - LLC Tax Voucher

CA Form 3525 - Substitute W-2, etc...

CA Form 3533 - Change of Address for Individuals

CA Form 3533-B - Change of Address for Businesses, Exempt Organizations, Estates and Trusts

CA Form 3534 - Tax Information Authorization

CA Form 3535 - Tax Information Authorization Revocation

CA Form 3536 - Estimated Fee for LLCs

CA Form 3537 - Payment for Automatic Extension for LLCs

CA Form 3538 - Payment for Automatic Extension for LPs, LLPs, and REMICs

CA Form 3539 - Payment for Automatic Extension for Corporations and Exempt Organizations

CA Form 3563 - Payment for Automatic Extension for Fiduciaries

CA Form 3567 - Installment Agreement Request

CA Form 3840 - California Like-Kind Exchanges

CA Form 4905 BE, Offer in Compromise Application – BE

CA Form 540-ES, Estimated Tax For Individuals

CA Form 541-ES, Estimated Tax For Fiduciaries

CA Form 565, Partnership Return of Income

CA Form 568, Limited Liability Company Return of Income

CA Form 593 - Real Estate Withholding Statement

CA Form 8454 - e-file Opt-Out Record for Individuals

CA Form DE 999A, Offer in Compromise Application

Form 656, Offer in Compromise

Inherited IRA - Required Minimum Distribution (RMD)

Troubleshooting

"Initial Validation Failed"

"Invalid user settings"

"Offline mode has expired"

"The program failed to initialize. Please re install the program."

"The program is already running"

Error: "An internet connection was not found"

Error: "The program cannot connect to the CFS server"

Finding or changing the Network Data Path

Import prior year 571s created in TaxTools WorkShop

Licensed software is stuck in demo mode

Mapped drives aren't visible

Recover Missing Clients

Remove All Client Locks

Repair Classic Client Database

Sending diagnostic logs to tech support

TaxTools WorkShop freezes on startup

Troubleshooting internet connectivity

User Account Control (UAC) message: "Do you want to allow this app to make changes to your device?"

View and send error logs

Adding a custom logo to worksheets

Silently install TaxTools WorkShop

Troubleshooting

Errors

"A transmitter TCC must be used to submit for more than one business"

"Cannot find associated company information" on IRS FIRE

"Component 'csftpax7.ocx' or one of its dependencies not correctly registered: a file is missing or invalid"

"Download failed" error

"Error 9 Subscript Out Of Range" when trying to 'Add/Edit Payroll Data'

"Exceeded maximum amount" with respect to Social Security and CA SDI withholdings

"Information provided is not correct" when logging into FIRE

"Not Saved" message when saving Firm Information

"Not saved" message when entering or exiting program

"OCX File Missing" or "OCX File Not Registered" error after updating Windows

"Registration file not found at the network"

"Small Fonts and Sans Serif can't be found" when Starting Program

"The app you're trying to install isn't a Microsoft-verified app"

"The feature you are trying to use..."

"The uploaded file contains one or more errors"

"This app can't run on your PC"

"This client is currently locked by another user. Access is denied."

"Unable to open infobase"

"User ID or Password Invalid" when attempting to log into IRS FIRE system

"[Program] is locked" when attempting to update

After installation the desktop shortcut icon is wrong or missing

CD install fails with message "Previous installation not found"

CFS Setup runs another vendor's installer

CFSSTRT: Program <File Name> was not Found in Folder <Folder Name> - Install may be Necessary

Checks are printing in regular font instead of MICR font used by banks

Component Not Registered or Component Missing error

Data Directory Invalid error

Error 0 or Error "MagMedSub.mdb is missing from the appath inis folder"

Error 1004: Error Accessing Database

Error 105: The transmission was unsuccessful

Error 12007 "Name not resolved" on Update from the Web

Error 12029 "Cannot Connect" on Update from the Web

Error 12031 when Downloading

Error 16 when Printing Form

Error 1706: No valid source could be found for product ( ). The Windows Installer cannot continue.

Error 2018: Page margins are too large, can't run report

Error 2019 when Printing Report

Error 3022 in Payroll System

Error 3031 when Restoring Payroll Data

Error 3045 in Payroll System

Error 3049 in Payroll System

Error 3050 in Payroll System

Error 3051 in Payroll System Network Installation

Error 3051: The Microsoft Jet database engine cannot open the file...

Error 3075 in Payroll System

Error 3078: The Microsoft Jet database engine cannot find...

Error 3112 in Payroll System

Error 3265: "Item not found in this collection"

Error 32765 when printing

Error 3343 in Payroll System

Error 339 "File is not correctly registered" During Install

Error 339: CSCMD32.OCX etc failed to self-register

Error 339: THREED32.OCX is not correctly registered

Error 339: VSSPELL6.OCX failed to self-register

Error 339: component missing or not properly registered

Error 3421 when Restoring Data

Error 35756 when Starting Program

Error 35761 when Attempting to Update

Error 35764 when Attempting to Update

Error 3633 when Starting Payroll System

Error 3800 in Payroll System

Error 380: Invalid property value

Error 381: Invalid property array index

Error 400: Form already displayed; can't show modally

Error 429 when Printing Form

Error 429: ActiveX component cannot create object

Error 429: You don't have an appropriate license to use this functionality

Error 480: Can't create AutoRedraw image

Error 482 when Trying to Print

Error 484 when Trying to Print

Error 48: Trouble loading DLL

Error 5001 on Installation

Error 5003 during Print Preview

Error 52: Bad file name or number

Error 53: File Not Found

Error 5: Invalid procedure call

Error 62: "Input past End of File"

Error 63 and Error 380

Error 6: Overflow

Error 7 when Starting Program

Error 70: Permission Denied

Error 75: Path/File Access Error

Error 9 and Error 381

Error 9 and Error 63

Error 94 - Invalid Use Of Null: When Trying To Add/Edit Payroll Data

Error MagMedSub.mdb is missing from the appath inis folder, or Error 0

Error Message: "A previous version of [program] was not found..."

Error Message: "Not a Valid Win32 Executable"

Error Message: "Version of the application could not be determined"

Error Message: "Zip file damaged"

Error TX4OLE invalid property value 1-900

Error Using Font - There was an error using the font OCR-ACFS [Payroll System Only]

Error: "Installed Version Could Not Be Determined"

Form is missing text and/or graphics (boxes, shading and lines)

Forms print on both sides of the paper

Install / Uninstall: Setup Runs Another Vendor's Installer

Installer's Repair option freezes on EXE files

Installing fonts manually

MICR Font Not Installed - The MICR font necessary to print on blank check stock is not installed

Mapped network drives are not visible during installation

Message During Automatic Backup: Change Backup Location - The Specified Location Cannot Be Used For The Backup

Message that something "needs to be installed" or "is on CD"

Modules do not load and no error is displayed

Move Data Process Errors

OCR-A (or OCR-ACFS) font is not properly installed

Only Client Demographic Data is Imported, No Client Folder Data is Imported (When Importing Data from the Prior Year)

Printing paychecks freezes Payroll System

Printouts are crunched into a small area at the top of the paper

Program Crashes Without Error Message when Printing

Program freezes after displaying Error 52: "Bad file name or number"

QBXML Query Response Error

Setup Stalls During Full Install

Still Running Old Version after Update

The top of the window is off screen

Update Setup Reports File Is Locked

Update Setup Stalls

When printing red forms all pages are blank

Your Network Data Is Read-Only

A client's file is not on the list of those that can be E-Filed

Can't scroll down to see all clients on the Step 2 tab of e-filing

Forms are printing with lines through the text

IRS website is unresponsive

Overlapping layers of text when printing

Running CFS software on Windows Arm-based PCs

Table of Contents

- All Categories:

- Program Instructions

- Payroll System

- E-Filing

- 1099 E-Filing

- Applying for FIRE Transmitter Control Code (TCC)

Applying for FIRE Transmitter Control Code (TCC)

Updated

by Eric

A FIRE Transmitter Control Code (TCC) is required to e-file 1099’s (and certain other information returns) to the IRS. You must electronically apply for a FIRE TCC through the IR Application described in this article.

Prior to getting started

- CFS is not a third-party transmitter. CFS does not file the W-2/1099s; you do. CFS creates the file which you will be able to upload to the IRS FIRE System.

- Existing FIRE TCC holders who didn't complete the IR Application (to keep their current TCC) by August 1, 2023 now have an expired TCC. A new TCC must be applied for using the procedure in this article.

- The IRS encourages transmitters who file for multiple issuers (clients, issuers of 1099's), to submit one application and use the assigned FIRE TCC for all issuers. The purpose of the FIRE TCC is to identify the transmitter of the file. You may transmit files for as many companies as you need to under the one TCC.

- Apply under the same name that is associated with your EIN (Form SS-4). On the IR application, add “Responsible Officials” (who will each need to sign up for ID.me, and, sign the IR Application with their own 5- digit PIN). Also on the IR application, add “Contacts” (who can each create a FIRE account on the IRS FIRE System website to E-file Information Returns using their firm’s TCC, EIN and Legal Business Name, should you choose to share this information with them).

- Sole Proprietors - You must have an EIN to apply for a FIRE (or IRIS) TCC code.

- If your EIN has changed, you will need to apply for a new Transmitter Control Code (TCC) because the TCC is linked to your EIN. The IRS requires a new TCC when there is a change in the EIN associated with the TCC.

Applying for a FIRE TCC

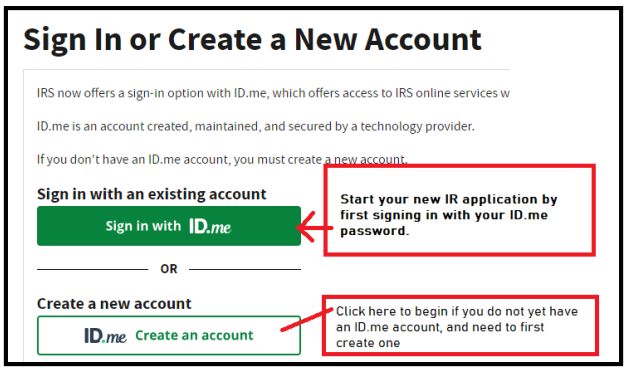

- Go to IR Application for TCC.

- Log-in with your ID.me user email and password.

- If you do not yet have an ID.me account, you will have to create one first.

The Create a new account option is for a new ID.me account—not a new IR application.Note that technical difficulties are not uncommon when creating an ID.me account. If you have phone camera difficulties under "Self-Service," choosing Video Chat Agent" is an option. Help links can also be found at the ID.me Help Center.

The Create a new account option is for a new ID.me account—not a new IR application.Note that technical difficulties are not uncommon when creating an ID.me account. If you have phone camera difficulties under "Self-Service," choosing Video Chat Agent" is an option. Help links can also be found at the ID.me Help Center.

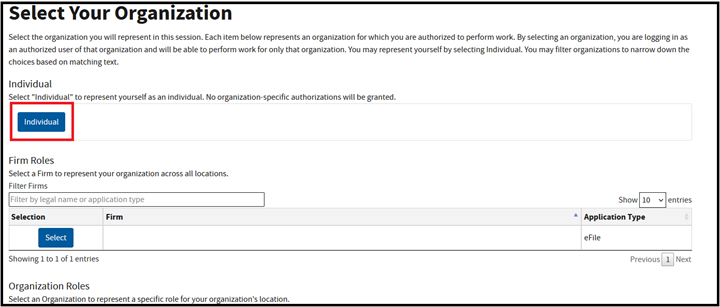

- Click Individual. The External Services Authorization Management webpage will open.

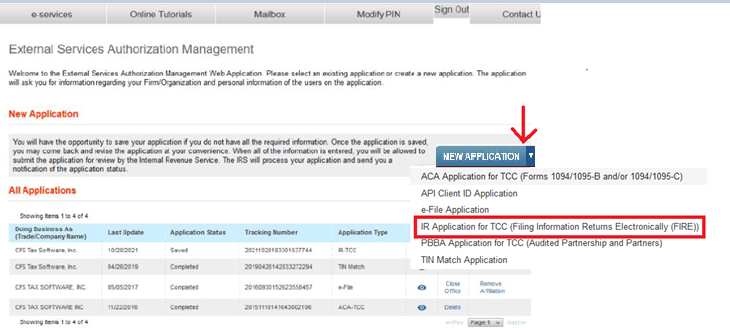

- Click New Application then click IR Application for TCC FIRE.

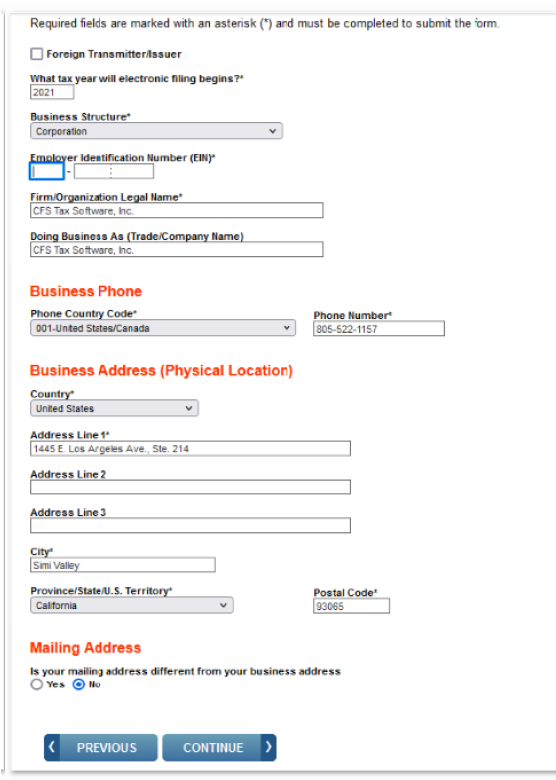

- Fill out the form and click Continue.As you continue through Application Screens, you will add information regarding your Responsible Officials and Contacts. If you are a Sole Proprietor/Individual or S Corp, only one Responsible Official and Contact are essential, whereas at least two are required for other Business Entities. If Two are required, you will add Responsible Officials (which will each sign the application with their own 5-digit PIN. All Responsible Officials (and also Authorized Delegates, should you choose to add them), will need an ID.me. See Adding additional Responsible Officials to a TCC application.Take note of the EXACT Firm/Organization Legal Name. It must be the same as that which is associated with your EIN, and can ONLY include the following punctuation/symbols: ampersand (&), period(s), dash(-), and comma(s).

Some applicants omit periods and commas associated with their EIN since they are not required on the IR application. However the Firm/Organization Legal Name as it appears on your IR application is how it must be input when later registering and signing on to the IRS FIRE System. EXCEPTION: If the IRS changes punctuation when assigning the TCC, use the legal business name as stated on your FIRE TCC assignment letter.

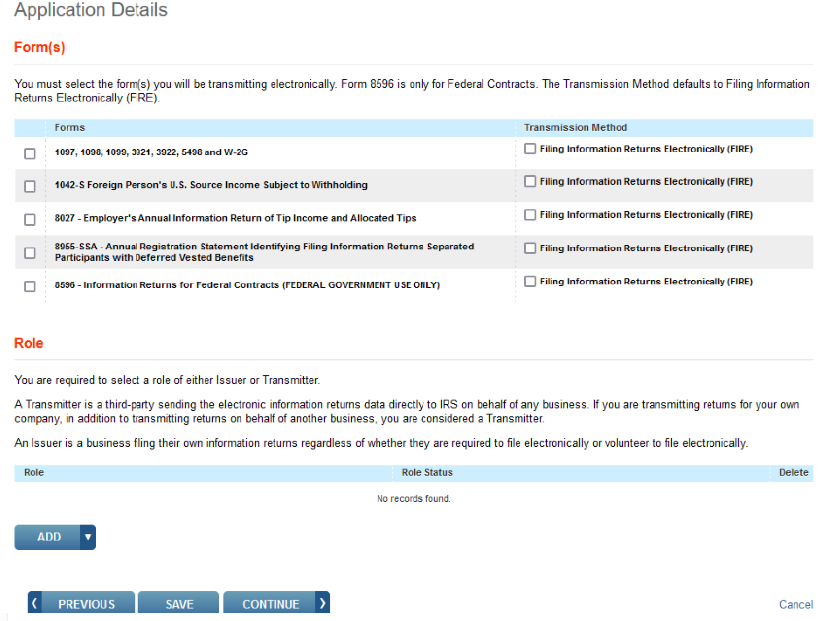

- Select the types of form(s) you will be submitting. Note that 1099’s are included in the first checkbox selection. Click ADD to select whether you are a Transmitter or an Issuer. Then click Continue.

The Tax Practitioners e-filing for Clients will choose Transmitter (and will still be able to e-file for their own company under the Transmitter option)

The Tax Practitioners e-filing for Clients will choose Transmitter (and will still be able to e-file for their own company under the Transmitter option) - Click ADD to add Responsible Officials. As you continue through the IR application screens, you will also add Contacts.Sole proprietors/individuals and S Corp: only one Responsible Official and Contact are essential

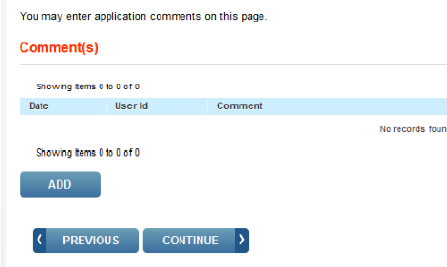

Other business entities: two are required. Each will also need to sign the application with their own 5 digit PIN and register with ID.me. See Adding additional Responsible Officials to a TCC application. - Add any application comments and click Continue.

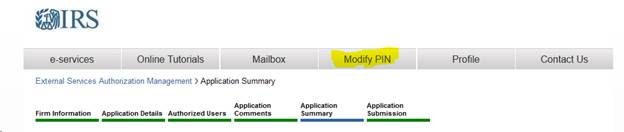

- Review the Application Summary and click Continue if it is correct.In the next step, you will be submitting your completed application. First verify that the Business Entity selection on the first page of your application is correct; it cannot be changed once submitted.

- Check I accept the terms of agreement, input your PIN, and click Submit.If you do not know your PIN, click Modify PIN on the IR application to get a new PIN.

- After you have signed and submitted the application, it is not complete until any other Responsible Officials also sign it with their own 5-digit PIN. Log out before they attempt to add their signatures. Retain a record of your 5-digit PIN in case it is needed for future applications or modifications (or IRS help). The IRS has to accept your submission before it is considered complete.For assistance in completing or PIN signing your IR application, call the FIRE System technical help line at 866-455-7438.

- An approval letter will be sent but you can find your TCC online before the letter arrives, sometimes in as little as a few days after submission. See Finding your TCC.IR Application is subject to review before the approval to transmit electronically is granted and may require additional documentation at the request of the Internal Revenue Service (IRS).

- See What to do when you receive your FIRE TCC.

FIRE System Phone Support

FIRE System Phone Support is called their “TSO line”.

Listen to all options before making your selection.

- Hours: Monday through Friday, 8:30A to 5:30P ET.

- 866-455-7438 (toll-free) this is the regular fire number

- 304-263-8700 (International) (Not toll-free)

- 304-579-4827 for Telecommunications Device for the Deaf (TDD) (Not toll-free)